Bitcoin Tumbles to 2026 Low of $85,200 as Gold Reverses Big Gains, Microsoft Leads Nasdaq Lower

Bitcoin Tumbles to 2026 Low of $85,200 as Gold Reverses Big Gains, Microsoft Leads Nasdaq Lower

The financial markets woke up to a brutal reality check today, marking one of the most severe synchronized sell-offs in recent memory. Bitcoin, the vanguard of digital assets, suffered an unprecedented drop, plunging to a staggering 2026 low of $85,200. This seismic event wasn't isolated; it rippled through every major asset class, forcing investors to grapple with a level of risk-off sentiment rarely seen outside of global recessions.

I remember the moment the notification flashed on my screen around 3 AM EST. I had gone to bed watching Bitcoin hover near the $100,000 psychological barrier, feeling relatively secure despite mounting macroeconomic headwinds. Waking up to a five-figure price tag, specifically $85,200, felt like a scene ripped from a doomsday prediction. The speed and depth of the plunge signaled that this was far more than a typical correction—it was a full-blown deleveraging event.

Adding to the chaos, traditional safe-haven assets failed to provide comfort. Gold, which had enjoyed robust gains earlier in the quarter, violently reversed course. Meanwhile, the technology sector bore the brunt of the equity panic, with giants like Microsoft leading the Nasdaq Composite sharply lower, signaling deep-seated fears about future growth prospects and rising interest rate sensitivity.

The Crypto Carnage: Why $85,200 Matters

Bitcoin’s precipitous fall to $85,200 represents more than just a large percentage drop; it shatters key technical support levels established during the previous bullish cycle and validates the intense fear surrounding central bank tightening policy. Analysts are pointing to several immediate catalysts, primarily massive forced liquidations in the derivatives market, compounded by deteriorating mining profitability.

The $85,200 level holds particular psychological significance as it represents the lower bound of the 2026 consolidation phase. Breaking this level confirms a decisive shift in market structure from a bearish trend into outright panic. Reports from major exchanges indicate billions of dollars in long positions were liquidated within a 12-hour window, accelerating the downward spiral in a classic 'waterfall' effect.

This widespread sell-off is fundamentally driven by the perception that the Federal Reserve and other global central banks are committed to maintaining high interest rates for longer than previously anticipated. When interest rates rise, highly speculative assets like cryptocurrencies lose their luster, as the cost of capital increases and the projected value of future cash flows (or in BTC’s case, future adoption) diminishes drastically.

Key indicators of the extreme stress in the digital asset sector include:

- The total cryptocurrency market cap shed over $600 billion in 48 hours.

- Bitcoin dominance (BTC’s percentage of the total market) temporarily spiked, suggesting altcoins were hit even harder as capital fled back to the largest, albeit falling, digital asset.

- Exchange trading volumes soared, hitting multi-month highs, typical of capitulation events.

- The Crypto Fear & Greed Index plummeted to a reading of 8 ("Extreme Fear").

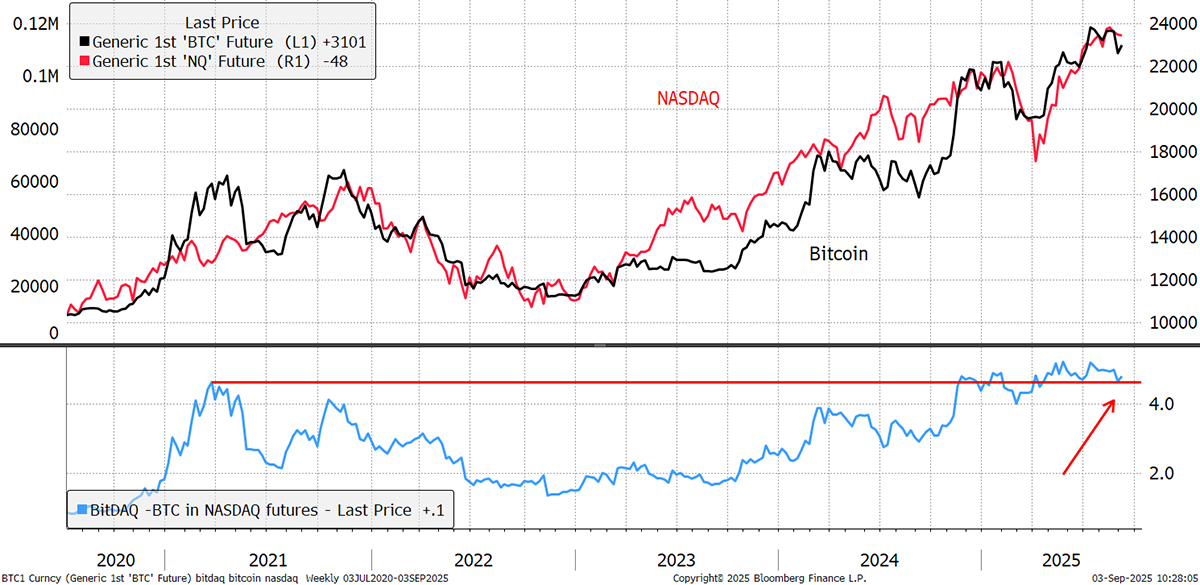

For long-term holders, the drop forces a difficult question: Is the correlation with traditional risk assets—particularly the Nasdaq—now permanent? Historically, Bitcoin was touted as an uncorrelated asset, but in severe liquidity crunches, everything is sold to cover margin calls, making it increasingly correlated with technology stocks.

The Flight from Safe Havens: Gold’s Unexpected Reversal

Perhaps the most perplexing component of today's market turmoil is the behavior of gold. The precious metal, traditionally viewed as the ultimate safe-haven asset and inflation hedge, should theoretically rally when confidence in risk assets evaporates. Instead, gold futures reversed significant gains, falling roughly 3% intraday after trading near record highs just last week.

This simultaneous drop in both Bitcoin (risk asset) and Gold (safe asset) provides a crucial clue about the nature of the current crisis: it is a liquidity crisis, not merely a crisis of confidence. When investors are forced to raise cash—whether to meet margin calls in the crypto sphere or the equity markets—they sell whatever they can that still holds substantial value. Gold fits this criteria.

The strengthening US Dollar Index (DXY) is playing a significant counter-role. As global investors panic, they often rush into US Treasury bills and the dollar itself, viewing them as the safest harbor in a storm. This robust demand for the greenback puts downward pressure on gold, which is priced in dollars, further exacerbating the reversal.

Economists suggest this market action signals investors are preparing for a deep global deflationary environment, rather than continued inflation. If central banks continue their aggressive tightening path, the resulting economic slowdown could make holding non-yielding assets like gold less appealing compared to high-yielding short-term Treasury notes.

Tech Titans Tremble: Microsoft and the Wider Nasdaq Fallout

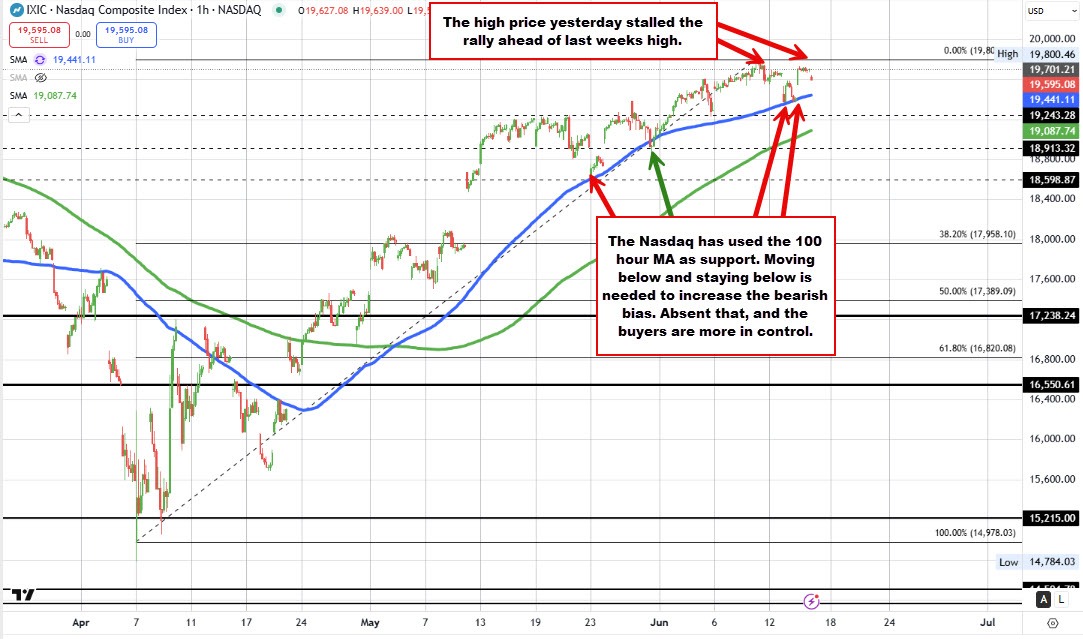

The pain in the equity market was centered squarely on technology stocks, confirming the tight correlation between highly valued growth companies and the prevailing interest rate environment. The Nasdaq Composite suffered its worst single-day drop since the pandemic crash, led primarily by substantial selling pressure on mega-cap stocks, most notably Microsoft (MSFT).

Microsoft, a bellwether for the entire technology sector due to its vast cloud computing division (Azure), saw its stock price fall by over 6%. This decline was driven by investor anxiety ahead of upcoming quarterly earnings reports and fears that a high-rate environment would significantly slow corporate IT spending, directly impacting Azure's profitability and valuation.

The entire FAANG+ complex faced similar pressure. These companies thrive on cheap capital and high projected growth. When the cost of borrowing soars and recession fears mount, their current valuations become unsustainable, prompting deep and necessary corrections.

Key factors driving the tech sell-off include:

- Treasury Yield Surge: The 10-year Treasury yield briefly crossed the 5.5% mark, making risk-free government bonds significantly more attractive relative to volatile growth stocks.

- Earnings Compression: Analysts are revising downward revenue projections for Q3 and Q4, particularly in advertising and cloud services.

- AI Hype Reversal: The immense capital expenditure required to fund AI initiatives now looks riskier given the higher cost of debt.

The market is sending a unified message: cash is king, and risk assets—whether they are speculative digital currencies, high-multiple tech stocks, or even traditionally safe commodities like gold—are being liquidated indiscriminately to meet liquidity demands. Until there is a clear pivot or verbal intervention from the Federal Reserve, investors should brace for continued volatility and further potential downside across all major asset classes.

For investors navigating this historic downturn, understanding the interconnectedness of these crashes is crucial. Bitcoin’s tumble to $85,200 is not just a crypto story; it is a signal of global financial system stress, magnified by the surprising flight from gold and the capitulation of the once-invincible technology sector.

The coming weeks will be critical, with focus shifting heavily to upcoming central bank meetings and the stability of the US banking sector, which might be increasingly stressed by the severe repricing of global assets.

Bitcoin tumbles to 2026 low of $85,200 as gold reverses big gains, Microsoft leads Nasdaq lower

Bitcoin tumbles to 2026 low of $85,200 as gold reverses big gains, Microsoft leads Nasdaq lower Wallpapers

Collection of bitcoin tumbles to 2026 low of $85,200 as gold reverses big gains, microsoft leads nasdaq lower wallpapers for your desktop and mobile devices.

Serene Bitcoin Tumbles To 2026 Low Of $85,200 As Gold Reverses Big Gains, Microsoft Leads Nasdaq Lower Artwork Concept

Explore this high-quality bitcoin tumbles to 2026 low of $85,200 as gold reverses big gains, microsoft leads nasdaq lower image, perfect for enhancing your desktop or mobile wallpaper.

Detailed Bitcoin Tumbles To 2026 Low Of $85,200 As Gold Reverses Big Gains, Microsoft Leads Nasdaq Lower Picture Digital Art

Explore this high-quality bitcoin tumbles to 2026 low of $85,200 as gold reverses big gains, microsoft leads nasdaq lower image, perfect for enhancing your desktop or mobile wallpaper.

Breathtaking Bitcoin Tumbles To 2026 Low Of $85,200 As Gold Reverses Big Gains, Microsoft Leads Nasdaq Lower Abstract Photography

Explore this high-quality bitcoin tumbles to 2026 low of $85,200 as gold reverses big gains, microsoft leads nasdaq lower image, perfect for enhancing your desktop or mobile wallpaper.

High-Quality Bitcoin Tumbles To 2026 Low Of $85,200 As Gold Reverses Big Gains, Microsoft Leads Nasdaq Lower Landscape Digital Art

Discover an amazing bitcoin tumbles to 2026 low of $85,200 as gold reverses big gains, microsoft leads nasdaq lower background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Crisp Bitcoin Tumbles To 2026 Low Of $85,200 As Gold Reverses Big Gains, Microsoft Leads Nasdaq Lower Picture in HD

Find inspiration with this unique bitcoin tumbles to 2026 low of $85,200 as gold reverses big gains, microsoft leads nasdaq lower illustration, crafted to provide a fresh look for your background.

Beautiful Bitcoin Tumbles To 2026 Low Of $85,200 As Gold Reverses Big Gains, Microsoft Leads Nasdaq Lower Image Collection

Discover an amazing bitcoin tumbles to 2026 low of $85,200 as gold reverses big gains, microsoft leads nasdaq lower background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Vibrant Bitcoin Tumbles To 2026 Low Of $85,200 As Gold Reverses Big Gains, Microsoft Leads Nasdaq Lower Background in HD

Experience the crisp clarity of this stunning bitcoin tumbles to 2026 low of $85,200 as gold reverses big gains, microsoft leads nasdaq lower image, available in high resolution for all your screens.

Detailed Bitcoin Tumbles To 2026 Low Of $85,200 As Gold Reverses Big Gains, Microsoft Leads Nasdaq Lower Landscape Nature

Transform your screen with this vivid bitcoin tumbles to 2026 low of $85,200 as gold reverses big gains, microsoft leads nasdaq lower artwork, a true masterpiece of digital design.

Amazing Bitcoin Tumbles To 2026 Low Of $85,200 As Gold Reverses Big Gains, Microsoft Leads Nasdaq Lower Background Art

Explore this high-quality bitcoin tumbles to 2026 low of $85,200 as gold reverses big gains, microsoft leads nasdaq lower image, perfect for enhancing your desktop or mobile wallpaper.

Captivating Bitcoin Tumbles To 2026 Low Of $85,200 As Gold Reverses Big Gains, Microsoft Leads Nasdaq Lower Wallpaper Collection

A captivating bitcoin tumbles to 2026 low of $85,200 as gold reverses big gains, microsoft leads nasdaq lower scene that brings tranquility and beauty to any device.

Mesmerizing Bitcoin Tumbles To 2026 Low Of $85,200 As Gold Reverses Big Gains, Microsoft Leads Nasdaq Lower Wallpaper Concept

Discover an amazing bitcoin tumbles to 2026 low of $85,200 as gold reverses big gains, microsoft leads nasdaq lower background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Spectacular Bitcoin Tumbles To 2026 Low Of $85,200 As Gold Reverses Big Gains, Microsoft Leads Nasdaq Lower Background Nature

Immerse yourself in the stunning details of this beautiful bitcoin tumbles to 2026 low of $85,200 as gold reverses big gains, microsoft leads nasdaq lower wallpaper, designed for a captivating visual experience.

Captivating Bitcoin Tumbles To 2026 Low Of $85,200 As Gold Reverses Big Gains, Microsoft Leads Nasdaq Lower Abstract for Desktop

This gorgeous bitcoin tumbles to 2026 low of $85,200 as gold reverses big gains, microsoft leads nasdaq lower photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Spectacular Bitcoin Tumbles To 2026 Low Of $85,200 As Gold Reverses Big Gains, Microsoft Leads Nasdaq Lower Scene Nature

This gorgeous bitcoin tumbles to 2026 low of $85,200 as gold reverses big gains, microsoft leads nasdaq lower photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Crisp Bitcoin Tumbles To 2026 Low Of $85,200 As Gold Reverses Big Gains, Microsoft Leads Nasdaq Lower Picture Art

Find inspiration with this unique bitcoin tumbles to 2026 low of $85,200 as gold reverses big gains, microsoft leads nasdaq lower illustration, crafted to provide a fresh look for your background.

Vivid Bitcoin Tumbles To 2026 Low Of $85,200 As Gold Reverses Big Gains, Microsoft Leads Nasdaq Lower Photo Concept

Experience the crisp clarity of this stunning bitcoin tumbles to 2026 low of $85,200 as gold reverses big gains, microsoft leads nasdaq lower image, available in high resolution for all your screens.

Stunning Bitcoin Tumbles To 2026 Low Of $85,200 As Gold Reverses Big Gains, Microsoft Leads Nasdaq Lower Image Illustration

Find inspiration with this unique bitcoin tumbles to 2026 low of $85,200 as gold reverses big gains, microsoft leads nasdaq lower illustration, crafted to provide a fresh look for your background.

Mesmerizing Bitcoin Tumbles To 2026 Low Of $85,200 As Gold Reverses Big Gains, Microsoft Leads Nasdaq Lower Picture Illustration

Experience the crisp clarity of this stunning bitcoin tumbles to 2026 low of $85,200 as gold reverses big gains, microsoft leads nasdaq lower image, available in high resolution for all your screens.

Artistic Bitcoin Tumbles To 2026 Low Of $85,200 As Gold Reverses Big Gains, Microsoft Leads Nasdaq Lower Photo in HD

A captivating bitcoin tumbles to 2026 low of $85,200 as gold reverses big gains, microsoft leads nasdaq lower scene that brings tranquility and beauty to any device.

Artistic Bitcoin Tumbles To 2026 Low Of $85,200 As Gold Reverses Big Gains, Microsoft Leads Nasdaq Lower Moment Photography

Find inspiration with this unique bitcoin tumbles to 2026 low of $85,200 as gold reverses big gains, microsoft leads nasdaq lower illustration, crafted to provide a fresh look for your background.

Download these bitcoin tumbles to 2026 low of $85,200 as gold reverses big gains, microsoft leads nasdaq lower wallpapers for free and use them on your desktop or mobile devices.