IFC Support Draws Two Private Equity Funds to Major Philippine Deals, Signaling Strong Market Confidence

IFC Support Draws Two Private Equity Funds to Major Philippine Deals, Signaling Strong Market Confidence

For years, attracting major global private equity (PE) players to the Philippine archipelago was a challenge. Despite robust consumer demand and strong demographic growth, concerns over regulatory hurdles and perceived political risk often kept significant institutional capital on the sidelines. But that narrative is changing fast.

In a major development for Southeast Asian finance, the International Finance Corporation (IFC) has successfully acted as the anchor, drawing two influential private equity funds into substantial Philippine deals. This strategic maneuver is more than just a financing arrangement; it’s a powerful vote of confidence in the nation’s rapidly maturing investment climate.

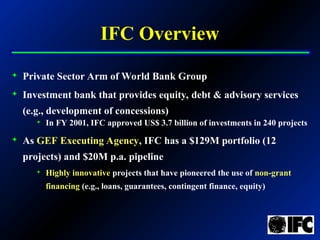

The involvement of the IFC, a core member of the World Bank Group, provides the necessary assurance and rigorous due diligence that skeptical international investors often require before committing billions to emerging markets. This move is expected to unleash a fresh wave of capital, specifically targeting critical sectors like infrastructure modernization, digital transformation, and sustainable healthcare delivery.

For Senior SEO Content Writers tracking global finance trends, this convergence of multilateral institutional backing and PE aggression signals a permanent shift in how the Philippines is viewed on the world stage. It validates years of governmental efforts toward improving the ease of doing business.

The Catalyst: How IFC De-Risks Investment in Emerging Markets

The International Finance Corporation plays a crucial role that extends far beyond simple capital injection. Its primary function in markets like the Philippines is sophisticated risk mitigation. When the IFC commits capital to a fund or a specific deal, it signals institutional confidence, adherence to stringent Environmental, Social, and Governance (ESG) standards, and alignment with global development goals.

Senior market analysts confirm that this stamp of approval drastically shortens the sales cycle for PE funds attempting to raise capital. Limited Partners (LPs) view IFC involvement as an essential insurance policy against unforeseen regulatory pitfalls, policy uncertainty, and operational inefficiencies often encountered in rapidly growing economies.

The strategic de-risking mechanism employed by the IFC was the critical factor that convinced the two private equity behemoths to commit resources where they might have previously hesitated. It elevates the Philippine investment climate from 'high-risk, high-reward' to 'validated, scalable opportunity.'

IFC’s support structure often involves multifaceted interventions:

- **Anchor Investment:** Committing a significant minority portion of the fund's total capital raise, ensuring immediate viability.

- **Technical Assistance and Advisory:** Providing localized expertise, especially concerning complex regulatory compliance and sustainable development practices crucial for long-term success.

- **Standard Setting:** Mandating that portfolio companies adhere to international best practices, making them highly attractive for future profitable exits, such as Initial Public Offerings (IPOs) or trade sales.

- **Conflict Resolution Facilitation:** Serving as a neutral party to help bridge gaps between international investors and local stakeholders.

This structural engagement minimizes political risk perception, making the vast market potential of 110 million consumers suddenly accessible to global institutional money.

Spotlight on the Funds: Profiles of the Committed Private Equity Giants

The identities and investment focus of the two attracted funds provide deep insight into the types of transactions currently being prioritized within the archipelago. While specific deal sizes and company names remain under wraps pending final agreements, the thesis of these PE firms clearly targets structural needs.

The first fund, often characterized as a “Global Growth Partner” specializing in APAC infrastructure, focuses heavily on large-scale, resilient projects. Their investment thesis aligns perfectly with the current Philippine government’s ongoing efforts to modernize national infrastructure, focusing on public-private partnerships (PPPs) in transportation and utilities.

This infrastructure focus is driven by the recognized necessity of reducing logistics costs within the Philippines, which remains one of the highest in the region. Improving cold chain storage and inter-island shipping capacity are high priorities for this fund’s capital deployment.

The second fund, identified as an “Asia Technology Catalyst,” specializes in mid-market investments within the digital economy. This focus capitalizes on the Philippines' rapidly growing digital penetration rate and its status as a leading global business process outsourcing (BPO) hub. The fund seeks high-growth portfolio companies that can leverage technology to scale services regionally and improve domestic operational efficiencies.

Examples of target investments for the technology-focused fund include:

- Fintech platforms addressing the high percentage of unbanked Filipinos.

- E-commerce logistics and warehousing solutions.

- Data center development necessary for localized cloud computing infrastructure.

- EdTech solutions designed for blended learning environments.

A crucial commonality between both funds is their mandate for sustainable development and measurable social impact, driven directly by IFC’s requirements. Capital allocations must now demonstrate not only financial returns but also significant improvements in governance and environmental stewardship.

Ripple Effect: Sectors Primed for Explosive Growth and Economic Transformation

The strategic capital infusion facilitated by IFC’s backing is not scattered broadly; it is precisely aimed at relieving economic bottlenecks. The influx targets specific industries that require immediate modernization and substantial capital expenditure to improve long-term national competitiveness.

The most immediate and substantial beneficiaries of this fresh capital are projected to be:

Healthcare Infrastructure and Services

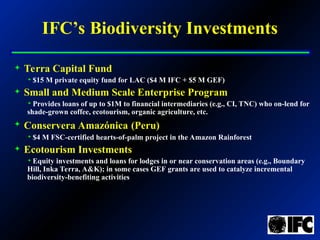

The pandemic exposed structural deficiencies in public and private healthcare systems. PE funds are looking at opportunities to build specialized hospitals, improve pharmaceutical supply chains, and integrate digital health solutions in underserved regional provinces. This promises better access and reduced urban congestion.

Logistics and Supply Chain Resilience

Investment here means upgrading critical national assets: modernizing key ports, developing smart road networks, and deploying technology to track goods efficiently. This directly lowers the cost of goods for consumers and increases the competitiveness of Philippine exports globally.

Digital Finance and Fintech

With a young, digitally native population, investment in secure payment gateways, e-wallets, and alternative lending platforms is essential. These deals accelerate financial inclusion, a core objective of the IFC’s mission.

Renewable Energy Generation

Capitalizing on the country's vast solar, geothermal, and wind potential is critical to meet growing industrial power demands sustainably. PE funding will support large-scale solar farms and offshore wind projects, reducing reliance on fossil fuels and stabilizing energy prices.

This structural change is vital. It enables local entrepreneurs and existing medium-sized firms to utilize growth capital that was previously unattainable, shifting businesses from relying solely on burdensome bank debt to utilizing equity financing. This promotes healthier, faster, and more ambitious scaling strategies under the guidance of world-class management.

Navigating the Local Dynamics: Commitment to Transparency and Long-Term Value

While the prospect of capital inflow is exciting, ensuring its effective and ethical deployment remains paramount. The Philippines offers unique operational dynamics that necessitate careful planning. The IFC's extensive presence ensures that transparency and long-term value creation are prioritized over short-term gains, mitigating common risks associated with policy changes and corruption.

Both Private Equity funds underwent exceptionally rigorous due diligence, scrutinizing potential political headwinds, regulatory stability, and macroeconomic stability indicators. Their decision to commit substantial amounts underscores a strong, growing confidence in the predictability of the Philippine market trajectory over the next seven to ten years.

The presence of the IFC ensures that capital flight is unlikely. These investments are specifically structured for permanence, focusing heavily on operational improvements, technology transfer, and governance upgrades, rather than speculative trading or quick flips. This focus on long-term commitment is paramount for creating sustained, high-value job growth.

Local stakeholders, including government economic planners and chambers of commerce, view this dual entry as a crucial validation of their efforts to improve the overall ease of doing business. It sets a powerful, actionable precedent for other multilateral institutions and major PE firms that have historically been cautious about large-scale investments in Southeast Asia.

As this news circulates throughout the global finance community, investment advisors anticipate a significant "third wave" of interest. Smaller, specialized sector-focused PE funds and venture capital firms are expected to follow the lead of these two major players, further deepening the capital markets and accelerating innovation.

The convergence of IFC support and significant commitments from two influential private equity funds marks a defining, positive moment for the Philippine economy. It transitions the nation from being merely a promising frontier market to a stable, validated destination for global institutional capital. Market observers will be closely tracking the performance of these initial portfolio companies, as their success will undoubtedly dictate the pace and scope of future PE inflows into the country.

The message delivered by the IFC's anchor role is clear: the Philippines is open for serious business, backed by the highest standards of international financial governance and a commitment to sustainable growth.

IFC support draws two private equity funds to Philippine deals

IFC support draws two private equity funds to Philippine deals Wallpapers

Collection of ifc support draws two private equity funds to philippine deals wallpapers for your desktop and mobile devices.

Mesmerizing Ifc Support Draws Two Private Equity Funds To Philippine Deals View Art

Experience the crisp clarity of this stunning ifc support draws two private equity funds to philippine deals image, available in high resolution for all your screens.

Gorgeous Ifc Support Draws Two Private Equity Funds To Philippine Deals Capture Collection

A captivating ifc support draws two private equity funds to philippine deals scene that brings tranquility and beauty to any device.

Detailed Ifc Support Draws Two Private Equity Funds To Philippine Deals View for Mobile

Experience the crisp clarity of this stunning ifc support draws two private equity funds to philippine deals image, available in high resolution for all your screens.

Captivating Ifc Support Draws Two Private Equity Funds To Philippine Deals Moment Art

Immerse yourself in the stunning details of this beautiful ifc support draws two private equity funds to philippine deals wallpaper, designed for a captivating visual experience.

Amazing Ifc Support Draws Two Private Equity Funds To Philippine Deals View Collection

Experience the crisp clarity of this stunning ifc support draws two private equity funds to philippine deals image, available in high resolution for all your screens.

Amazing Ifc Support Draws Two Private Equity Funds To Philippine Deals Wallpaper in 4K

Transform your screen with this vivid ifc support draws two private equity funds to philippine deals artwork, a true masterpiece of digital design.

Serene Ifc Support Draws Two Private Equity Funds To Philippine Deals Capture for Desktop

Discover an amazing ifc support draws two private equity funds to philippine deals background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Vivid Ifc Support Draws Two Private Equity Funds To Philippine Deals Moment Photography

Experience the crisp clarity of this stunning ifc support draws two private equity funds to philippine deals image, available in high resolution for all your screens.

Gorgeous Ifc Support Draws Two Private Equity Funds To Philippine Deals Design for Your Screen

A captivating ifc support draws two private equity funds to philippine deals scene that brings tranquility and beauty to any device.

Vivid Ifc Support Draws Two Private Equity Funds To Philippine Deals Picture Nature

Discover an amazing ifc support draws two private equity funds to philippine deals background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Spectacular Ifc Support Draws Two Private Equity Funds To Philippine Deals Scene Collection

Find inspiration with this unique ifc support draws two private equity funds to philippine deals illustration, crafted to provide a fresh look for your background.

Breathtaking Ifc Support Draws Two Private Equity Funds To Philippine Deals Moment Digital Art

Transform your screen with this vivid ifc support draws two private equity funds to philippine deals artwork, a true masterpiece of digital design.

Lush Ifc Support Draws Two Private Equity Funds To Philippine Deals Landscape for Your Screen

This gorgeous ifc support draws two private equity funds to philippine deals photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Vivid Ifc Support Draws Two Private Equity Funds To Philippine Deals Image Digital Art

Explore this high-quality ifc support draws two private equity funds to philippine deals image, perfect for enhancing your desktop or mobile wallpaper.

Beautiful Ifc Support Draws Two Private Equity Funds To Philippine Deals Design Art

Explore this high-quality ifc support draws two private equity funds to philippine deals image, perfect for enhancing your desktop or mobile wallpaper.

Vivid Ifc Support Draws Two Private Equity Funds To Philippine Deals View Collection

Explore this high-quality ifc support draws two private equity funds to philippine deals image, perfect for enhancing your desktop or mobile wallpaper.

Crisp Ifc Support Draws Two Private Equity Funds To Philippine Deals Design for Desktop

A captivating ifc support draws two private equity funds to philippine deals scene that brings tranquility and beauty to any device.

Detailed Ifc Support Draws Two Private Equity Funds To Philippine Deals View for Your Screen

Discover an amazing ifc support draws two private equity funds to philippine deals background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Gorgeous Ifc Support Draws Two Private Equity Funds To Philippine Deals Artwork Nature

Immerse yourself in the stunning details of this beautiful ifc support draws two private equity funds to philippine deals wallpaper, designed for a captivating visual experience.

Artistic Ifc Support Draws Two Private Equity Funds To Philippine Deals Design Illustration

A captivating ifc support draws two private equity funds to philippine deals scene that brings tranquility and beauty to any device.

Download these ifc support draws two private equity funds to philippine deals wallpapers for free and use them on your desktop or mobile devices.